Inflation

Inflation

A persistent increase in the average price level in the economy, usually measured through the calculation of a consumer price index (CPI)

Disinflation

A falling rate of inflation.

Deflation

A persistent fall in the average price level in the economy. It implies negative inflation rates.

Consumer price index (CPI)

A measure of the average rate of inflation which calculates the change in the prices of a representative basket of goods and services consumed by the average household.

Causes of inflation

Monetary inflation: This will only occur if the rate of growth of the money supply is greater than the increase in the level of output in the economy, so forcing up prices.

- Fisher equation: MV = PT M=money supply, V=the number of times money changes hands P=the price level T=the output or transactions in the economy

Demand-pull inflation: is a persistent increase in the average price level that comes about as a result of increases in aggregate demand (AD).

- A depreciation of the exchange rate increases the price of imports and reduces the foreign price of exports. If consumers buy fewer imports, while exports grow, AD will rise.

- Higher demand from a fiscal stimulus via a reduction in direct or indirect taxation or via higher government spending.

- Monetary stimulus to the economy: a fall in interest rates may stimulate too much demand for bank loans or causing sharp rise in house price inflation. This cause people to spend more with rising consumer confidence with increased value of their assets.

- Faster economic growth in other countries-providing a boost in export overseas. Export sales provide an extra flow of income and spending into domestic flow and thus to push AD increase further.

Cost-push inflation: is a persistent increase in the average price level that comes about as a result of increases in the costs of production and thus a decrease in aggregate supply (AS).

- Price Increase in raw materials and other components. Eg. Rise in the world commodity prices such as oil, cooper and agricultural products, etc.

- Rising labor costs-caused by wage increases greater than improvements in productivity.

- Substantial fall in the exchange rate. This can cause the price of imports to increase substantially while the price of exports in terms of other countries’ currencies reduces. Inflation may rise rapidly

- Higher indirect taxes imposed by the government or reduced subsidy

Effects of inflation

DIS

- A reduction in net exports: Inflation may reduce the international competitiveness of a country’s products and so increase import expenditure and lower export revenue.

- Menu costs: means the costs involved in changing prices.

- Shoe leather costs: These are the costs involved in moving money from one financial institution to another in search of the highest rate of interest.

- An unplanned redistribution of income: Some people may gain and some people may lose as a result of inflation.

- Discouragement of investment: Unanticipated inflation can create uncertainty and so make it more difficult for firms to plan ahead.

- Inflation causing inflation: Inflation may generate further inflation as consumers, workers and firms will come to expect prices to rise.

AD

- Stimulating output: A low and stable inflation rate caused by increasing demand may make firms feel optimistic about the future. In addition, if prices rise by more than costs, profits will increase, which will provide funds for investment.

- Reduce the burden of debt: Real interest rates may fall due to inflation or may even become negative.

- Prevent some unemployment: Firms in difficulties may have to reduce their costs to survive. For many firms, wages form a significant proportion of their total costs. With zero inflation, firms may have to cut their labor force. However, inflation would enable them to reduce the costs of labor by either keeping nominal (money) wages constant or by not raising them in line with inflation. During inflation, workers with strong bargaining power are more likely to be able to resist cuts in their reaI wages than workers who lack bargaining power.

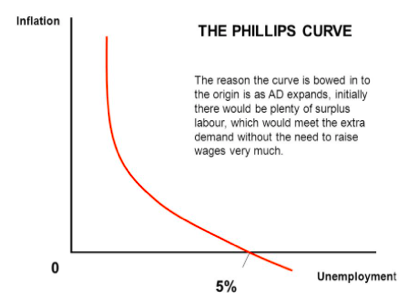

The short run Phillips curve (SRPC)

A curve that shows an inverse relationship or a “trade-off” between the inflation rate and the unemployment rate in the short run.

Stagflation

The situation where an economy is facing stagnant growth, with the combination of high unemployment and high inflation. It is the result of a decrease in SRAS due to factors including negative supply shocks.

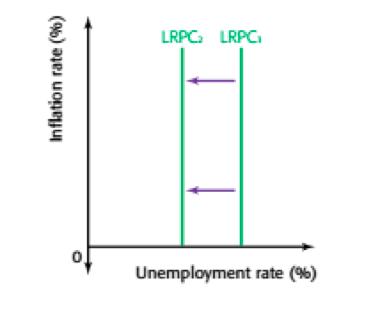

Long run Phillips curve (LRPC)

A vertical line at the natural rate of unemployment that illustrates the view that there is no trade-off between the inflation rate and the unemployment rate.

Trade-off between inflation and unemployment

LPIf government decides to decrease unemployment by rising expenditure, AD will increase, also the real output and price. Workers will negotiate for higher Wages. After wage rises, firm have to lay-off workers to reduce cost of production, which shift SRPC to the right. So, any attempt to use demand side management again to reduce unemployment below natural rate will only result in higher inflation & a move to another SRPC3. At any given point in time, there may be a SR trade-off betwee inflation & unemployment, but the economy will always return to unemployment at natural rate. Government cannot reduce this rate by using D-side policies.

No Comments