Protectionism

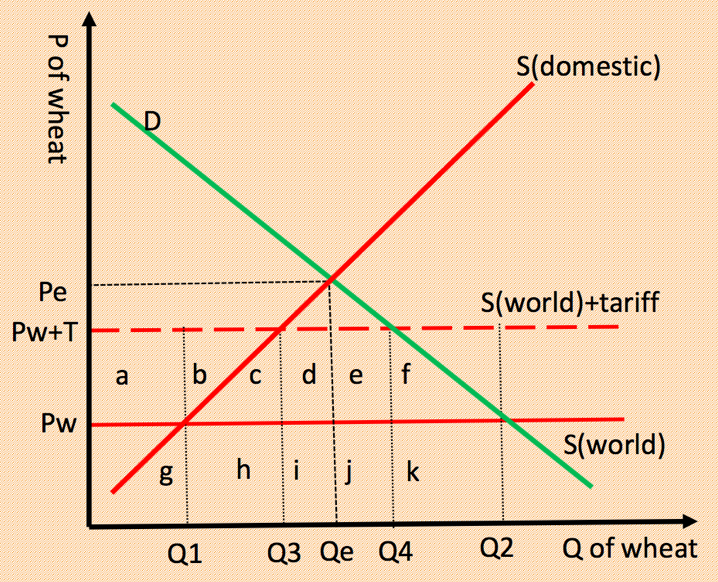

Tariffs

A tax impose on imported goods. (regressive tax). It is regressive because the tariff on a good would be higher proportion of low income earners than it would be on high income earner.

Area C: Loss created by inefficient production of domestic producers Area F: Loss of consumer surplus. Change in consumer surplus: (Q4+Q2) * PT / 2 Change in producer surplus: (Q1+Q3) * PT / 2 Change in government revenue: no change & no revenue

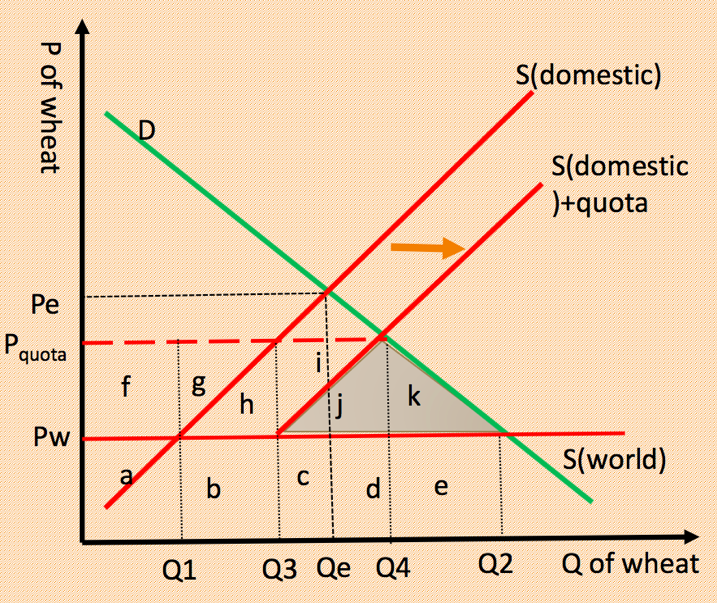

Quotas

The limit on the numbers or value of goods that can be imported into a country.

Area k: Loss created by inefficient production of domestic producers

Area h: Loss of consumer surplus.

Change in consumer surplus: (Q4+Q2) * Pquota – Pw / 2

Change in producer surplus: (Q4+Q3) * Pquota – Pw / 2

Change in government revenue: no change & no revenue

Area k: Loss created by inefficient production of domestic producers

Area h: Loss of consumer surplus.

Change in consumer surplus: (Q4+Q2) * Pquota – Pw / 2

Change in producer surplus: (Q4+Q3) * Pquota – Pw / 2

Change in government revenue: no change & no revenue

Administrative barrier

Red tape (expensive paper work): Require to fill out a considerable amount of time-consuming paperwork.

Quality standards: Require imports to reach artificially high standards (health safety and environment standard.

Embargo: Complete ban on the import of a product or trade with another country.

National campaigns

Government will sometimes run marketing campaigns to encourage people to buy domestic goods instead of foreign products in orders to increase more demand for domestic goods and preserve domestic jobs.

Exchange control

Types of controls that governments put in place to ban or restrict the amount of foreign currency or local currency that is allowed to be traded or purchased.

- Banning the use of foreign currency

- Restricting the amount of domestic currency that can be exchanged within the country.

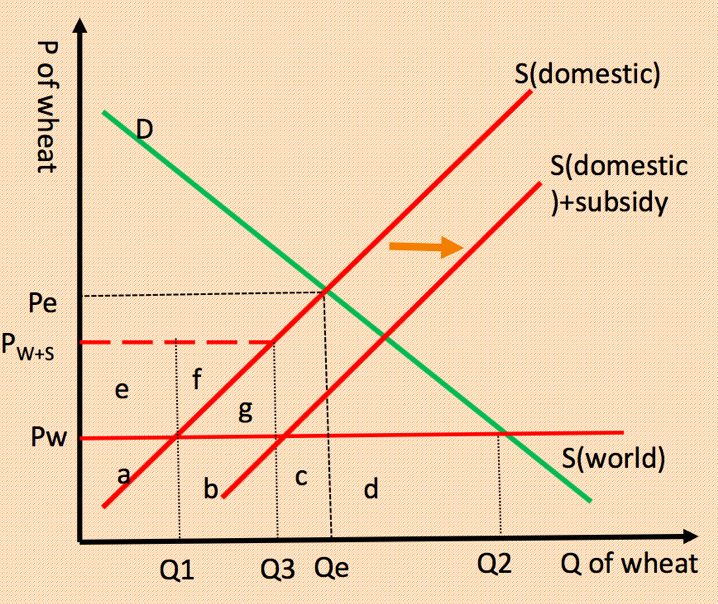

Production subsidy

Subsidy is an amount of money paid by the government to a firm, per unit of output, to encourage output and to give the firm an advantage over foreign competition.

Producer surplus:(Q3+Q1) * subsidy / 2

Consumer surplus: unchanged

Government expenditure: Subsidy = e + f + g = (Pw + S) * (Q1+Q3)

Welfare loss: (area g) Loss created by inefficient production of domestic producers; resources spend on subsidizing inefficient domestic producers

Producer surplus:(Q3+Q1) * subsidy / 2

Consumer surplus: unchanged

Government expenditure: Subsidy = e + f + g = (Pw + S) * (Q1+Q3)

Welfare loss: (area g) Loss created by inefficient production of domestic producers; resources spend on subsidizing inefficient domestic producers

No change in price Subsidy serves for incentive

Inefficient production: Q1Q3 is produced by inefficient domestic producers. Foreign producers would produce this quantity for a minimum revenue of b, but DPs need b+g. More of world resources are used to produce wheat than are necessary.

Although consumer does not loss any surplus, however they are affected. Government use tax revenues to fund subsidies. (Consumers (taxpayers) eventually are burdened by the cost of subsidy.)

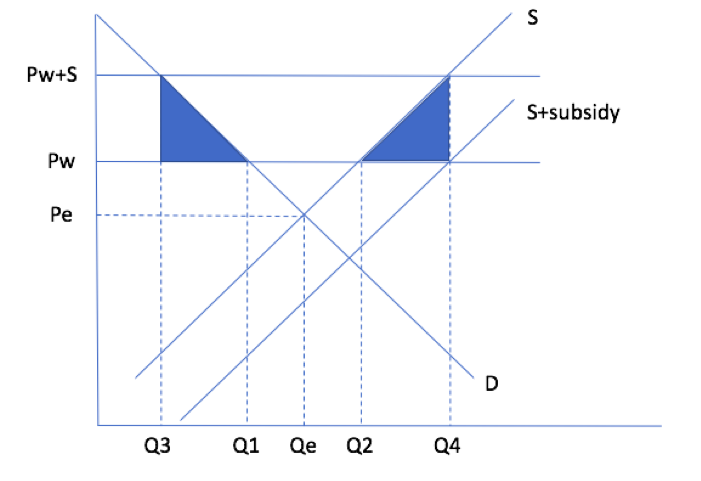

Export subsidy

Producer surplus: (Q4+Q2) * Subsidy / 2 Consumer surplus: (Q3+Q1) * Subsidy / 2 Government expenditure: Subsidy = (Q4-Q3) * subsidy Welfare loss: (Q1-Q3) * subsidy [loss of consumer surplus] + (Q4-Q2) * subsidy [inefficient production of domestic producer]

Voluntary export restrains (VERs)

Persuade export country to agree to restrict the number of units of a product sold by it.

Arguments for protectionism

- Safeguard employment in the home country. As import penetration rises, domestic firms come under increasing pressure to maintain sales which may result in considerable structural unemployment and can lead to calls for some protection.

- Protecting the economy from low-cost labor. The economy should be protected from imports that are produced in countries where the cost of labor is low.

- Protecting infant industries, declining industries and strategic industries

Infant industries: New industries that have a low output and a high average cost. Sunset industries: If declining industries go out of business quickly, there may be a sudden and large rise in unemployment. Strategic industries: agricultural and defense related industries; power generation.

- Prevent dumping. Dumping is the process of selling goods in an overseas market at price below the cost of production.

Arguments against protectionism

- Higher price for consumers and producers to buy imports

- Less choice for consumers

- Lack of foreign competition leads to inefficiency and less innovation

- Specialization is reduced due to protectionism, which would reduce the potential level of the world’s output

- Protectionism may hinder economic growth

- Protectionism may result in retaliation