Inequality

Inequality & equity

Equality in distribution of income = a narrow wealth gap Equity in distribution of income = fairness Equity ≠ equality

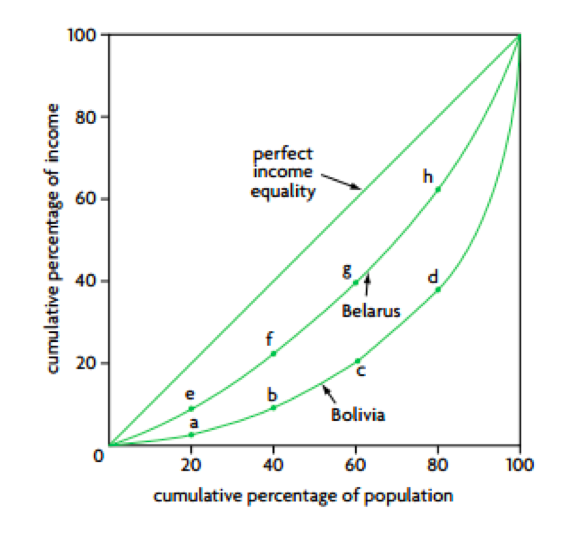

Lorenz curve

A graphical measure of a country’s income distribution within its population. It shows what percentage of the population earns what percentage of the total income in the economy. It is calculated in cumulative terms. The further the curve is from the line of absolute equality (45 degree line), the more unequal is the distribution of income.

The Gini coefficient

A summary measure of income inequality, and in a Lorenz diagram is the ratio of the area between the diagonal and the Lorenz curve, to the total area under the diagonal.

- Gini coefficient = area between diagonal and Lorenz curve / entire area under diagonal

- It has a value between 0 and 1

- the closer the value is to 0, the greater the income equality

- the closer the value is to 1, the greater the income inequality.

Poverty

Refers to an inability to satisfy minimal consumption needs.

Absolute poverty

The condition experienced by individuals who cannot afford to acquire the basic necessities for a healthy and safe existence (e.g. sanitation, shelter, clean water, nutrition & healthcare).

Relative poverty

The condition experienced by people in a country whose incomes are considerably lower than the higher income groups in the same country.

Causes of poverty

- Low incomes

- Unemployment

- Low level of human capital (lack of education, skills & access to healthcare make workers less productive)

- Low levels of capital or land ownership

- Discrimination: Some social groups (racial and ethnic groups, women) may face discrimination in the job market, with the result that they may receive lower wages

- Geography: Some people may live in remote, isolated geographical regions

- Age: Older people

- Poverty itself may become a cause of further poverty

To promote equity

Progressive tax

AD

- Reduces tax burden on lower income earners.

- Promotes equality in income distribution.

DIS

- Disincentive effect: discourage ppl from working harder & taking risks - punish hard work, productivity & innovation.

- Encourages tax evasion: huge complexity of tax system, ppl find ways to avoid paying taxes.

Proportional effect

AD

- Simplest form of taxation, leaving little room for error or manipulation (lower administrative costs) Simple & more transparent & fairer as loopholes do not exist which usually higher-income households take advantage of.

- Gov’t can collect the amount of revenue that it expects to collect.

- Encourages greater incentive to work & thus raise labor S (lower disincentive effects)

Regressive tax

AD

- A good & stable source of gov’t revenue.

- Discourages the consumption of demerit goods.

DIS

- Inequitable: it worsens income inequality.

- Place a larger burden on lower-income ppl with lower ability to pay & a smaller burden on higher-income earners with greater ability to pay.

- Lower-income earners pay a larger % of their income in tax than higher-income earners.

- Avoidable.

Gov’ts undertake expenditures to provide directly, or to subsidize, a variety of socially desirable goods & services, thereby making them available to those on low incomes:

- merit goods: health care services & education

- infrastructure: sanitation & clean water supplies

Transfer payments

A payment from the government to an individual for which no good or service is exchanged. They are a means of redistributing income in an economy from one group to another.

Social security legislation

Requires firms to contribute to workers’ medical insurance & pensions.

Minimum wage policy

Ensures that workers are paid a “fair” wage

Subsidies on basic foodstuffs & public transportation

To reduce the cost & increase consumption

Maximum price on food & rents

Ensure they are affordable for people living on low incomes

Negative effects of promoting equity

-

Government’s role in Distribution of income interferes with mkt forces and results in inefficiency (MSB≠MSC): there is a trade-off between equity & efficiency.

-

Government policies to promote equity may reduce efficiency in Allocation of Resources:

- Progressive taxation: disincentive effect: ↓incentives, discourages hard work & entrepreneurial activity (leave c searching more “favorable” tax climates), negative effects on overall growth; encourages tax evasion.

- Government expenditure: public provision of merit goods (education &health care) is often under-supplied & may be less efficient than private provision.

- Transfer payments: not included in national income & may ↓incentives to work (often do not ↑productivity).

-

Employment regulations add to LM inefficiency: firms paying insurance/social security costs contributes to unemployment as they’d hire fewer workers.

-

Minimum wage: prevent labor market from being cleared → unemployment

-

Subsidies on food & public transportation: OC of G, budget problem

-

Maximum price on food & rents: shortage…

Positive effects of promoting equity

- Poverty reduction

- Investment in human capital (education, health care )

Progressive tax is a main way for a government to promote equity in distribution of income

- (Equity:) the most equitable tax: places the largest burden on high-income earners, allow those with the greatest ability to pay the greatest tax.

- (Equality:)↓inequity in distribution of income : effective means to redistribute income from higher income earners to low income earners. Taxes collected from higher-income earners used to provide socially desirable goods and services & transfer payment to lower-income people.