Government interventions

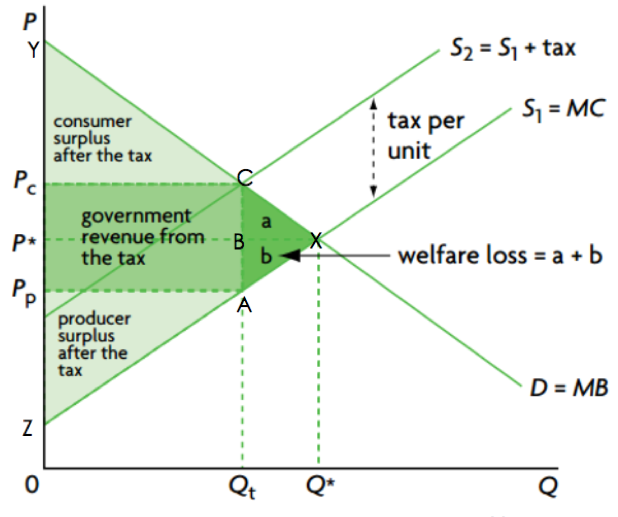

Taxes

Charges that are imposed by governments on people and business.

Direct taxes

Taxes the income of people and firms; involving payment of the tax by the taxpayers directly to the government.

Indirect taxes

A tax that is levied on the spending to buy goods and services, they are paid partly by consumers, but are paid to the government by producers (firms)

Ad valorem taxes

A fixed percentage of the price of the good or service; in this case, the amount of tax increases as the price of the good or service increases. (non-parallel shift)

Specific taxes

A fixed amount of tax per unit of the good or service sold. (parallel shift)

Proportional taxes

Whereby as income rises, the proportion of income paid in tax remains the same; the tax rate is therefore constant.

Progressive taxes

A tax that when income rises, the proportion of the total paid in taxes increases; the average rate of taxation will therefore be lower than the marginal rate.

Regressive taxes

A tax that as income rises, the proportion of total income paid in tax falls. Hence, the average and the marginal rates of taxation are falling.

Tax burden

|

| PED>PES | Most of the tax incidence is on producers |

| PED<PES | Most of the tax incidence is on consumers |

| PED=PES | Tax burden is shared equally by consumers and producers |

Stakeholders

- Consumers are worse off

- Producers are worse off

- Government is better off

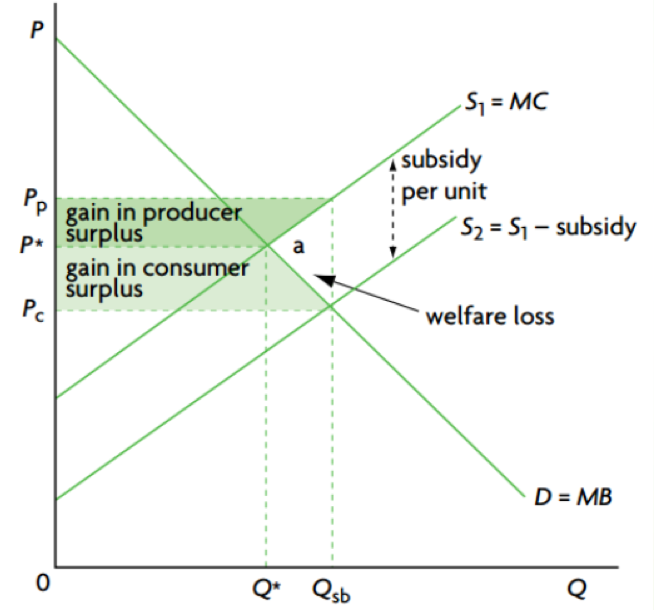

Subsidy

Refers to assistance by the government to individuals or groups of individuals, such as firms, consumers, industries or sectors of an economy.

Purpose of subsidy

- To increase revenues of producers.

- To make necessities affordable to low-income consumers.

- To encourage production and consumption of particular goods and services (merit goods) that are desirable for consumers. (healthcare, education)

- To support the growth of particular industries in an economy.

- To improve the allocation of resources (reduce allocative inefficiencies) by correcting positive externalities.

Stakeholders

- Consumers are better off

- Producers are better off

- Government is worse off

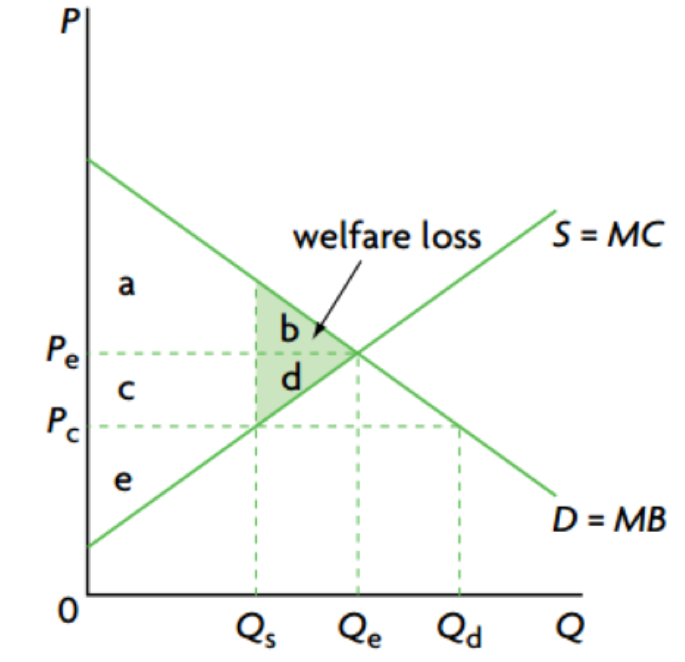

Price ceiling

A maximum legally allowable price for a good, set by the government, below the market price, aiming to protect (low- income) consumers.

Consequences of price ceiling

- Shortage

- Underground market

- Under-allocation of resources to the good

- Allocative inefficiency

Stakeholders

- Consumers partly gain partly lose

- Producers are worse off

- Government gain political popularity

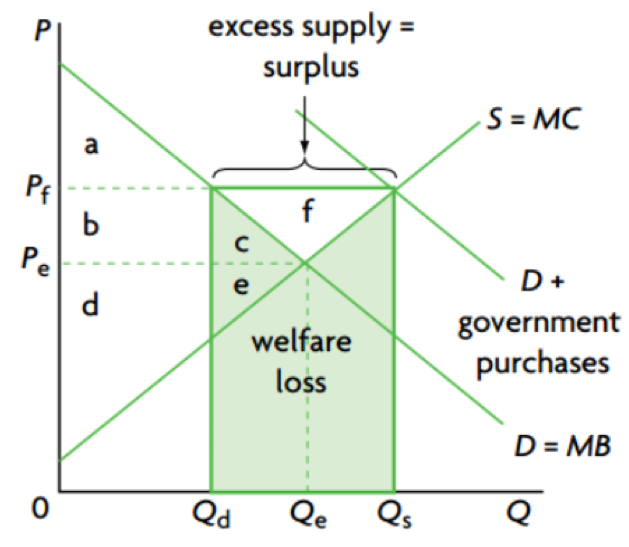

Price floor (minimum price)

The price that can be legally charged by sellers of the good must not be lower than the price floor, or minimum price.

Purpose of price floor

- To provide income support for farmers by offering them prices for their products that are above market determined prices

- To protect low-skilled, low wage workers by offering them a wage (the minimum wage) that is above the level determined in the market.

- There is strong political support for imposing minimum wage.

Stakeholders

- Consumers are worse off

- Producers are better off

- Government is worse off

- Workers have greater chance to find job

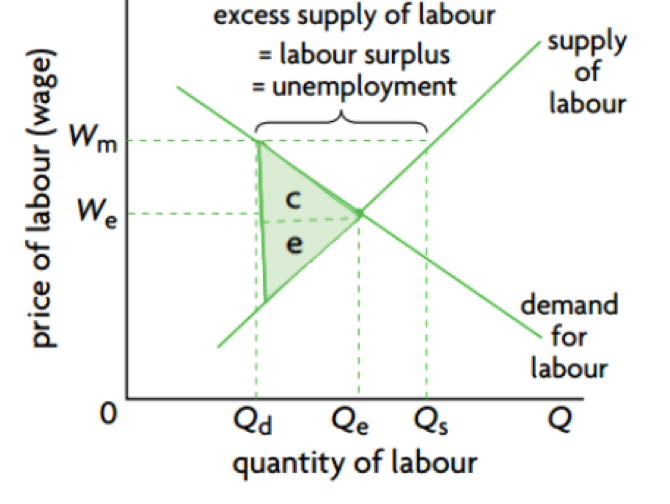

Minimum wages

A form of price floor, a legal minimum price for labor, set by the government. The government wants to protect workers, ensure them to earn enough to lead a reasonable existence.

Consequences of minimum wage

- Labor surplus and unemployment

- Illegal employment

- Misallocation of labor resources

- Misallocation in product market (Disincentive effect; Rely on unskilled workers)

Stakeholders

- Consumers are worse off

- Firms are worse off

- Workers some gain some lose