Demand-side policies

Governments earns revenue primarily from:

- Taxes (direct and indirect)

- Sale of goods and services

- Sale of state-owned (government-owned) enterprises

Government spending can be classified into

- Current expenditures

- Capital expenditures

- Transfer payments

A budget deficit

Exists when planned government spending exceeds planned government revenue.

Demand-side policies (demand management policies)

Macroeconomic policies aimed at changing (stimulating or decreasing) the level of AD in the economy deliberately in order to achieve macroeconomic objectives. They include fiscal and monetary policy.

Fiscal policy

The government’s use of spending and taxes to influence (stimulate or contract) the overall level of AD in the economy to promote the macroeconomic goals.

Commercial banks

Financial institutions (which may be private or public4) whose main functions are to hold deposits for their customers (consumers and firms), to make loans to their customers, to transfer funds by check and electronically from one bank to another, and to buy government bonds.

A central bank

- Issuing currency

- Managing the money supply

- Controlling interest rates.

Interest rate

The price of credit or borrowed money; the cost of borrowing money; the return of saving money in banks; the opportunity cost of spending money.

The supply of money

It is fixed at a level that is decided upon by the central bank. It appears as a vertical line, Sm, because it does not depend on the rate of interest.

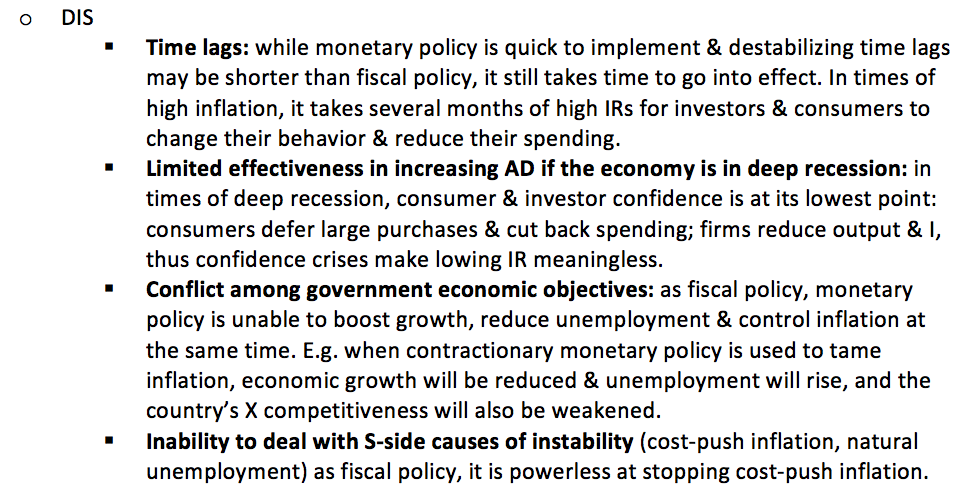

Monetary policy

Monetary policy is the set of central bank’s policies concerning money supply and interest rate. It may be used to manage the level of aggregate demand (AD).